It’s no secret that index funds are one of the best ways to build wealth passively. When chosen correctly, they can provide predictable growth and stability. Today’s post is a guide on index funds for beginners.

If you’re new to finance or searching for a dependable investment strategy, come with me as we explore the straightforward, effective, and promising nature of index funds. I’ll help you start your journey into the world of smart and rewarding investing.

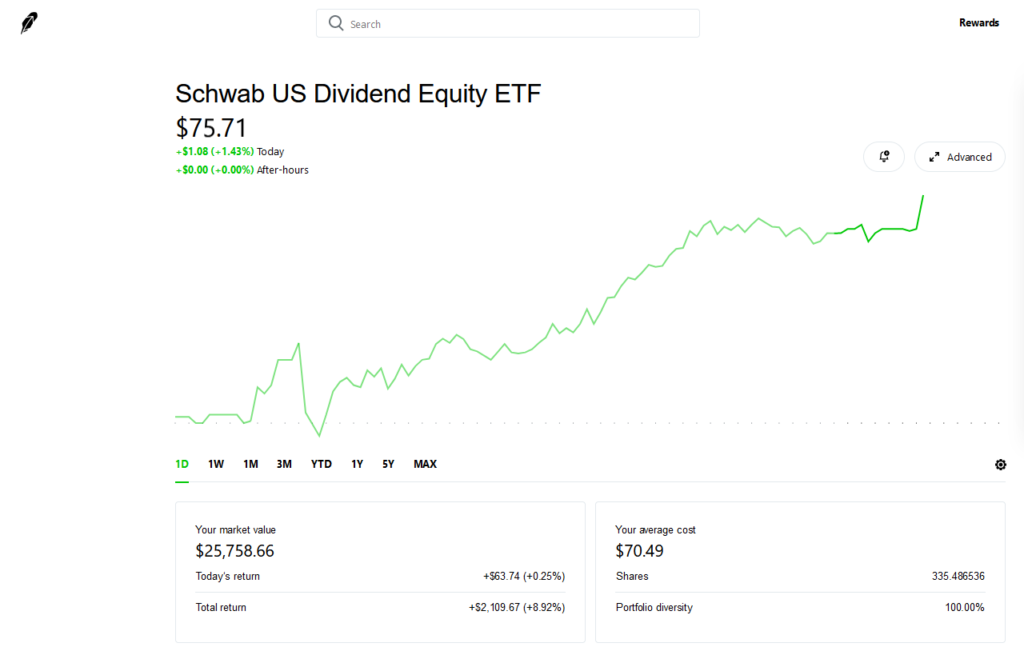

For beginners looking to dive into index funds, I suggest using Robinhood. With no commission fees and free trades, it’s a straightforward choice without any hidden catches. I’ve personally used this platform for several years alongside my other brokerages. It’s user-friendly and even enjoyable for regular stock trading. If you’re interested in opening an account, you can get a free stock by clicking on my referral link here.

Here’s My Personal Account

I have been able to accumulate over 28,000 just by investing in one index fund! I will get into more below.

What Index Fund Should You Invest In?

If you’re just starting as an investor, focus on index funds that show promise for future growth and provide good value for your investment.

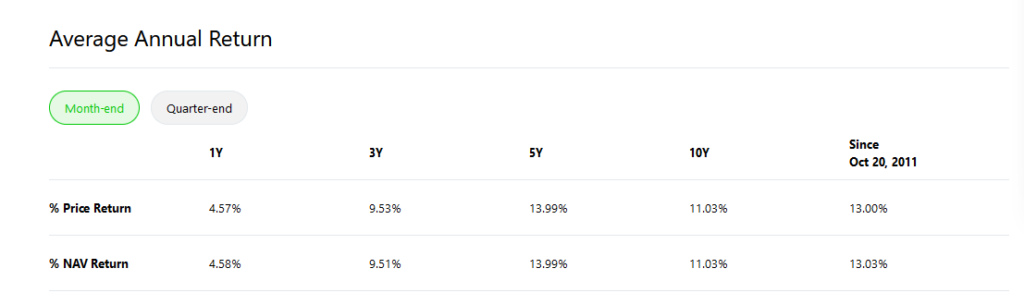

Its a good idea to look for index funds that have proven a yearly return of about 10% over the past 10-20 years. We will dive deeper into that below!

I have personally chosen an index fund called SCHD which focuses on dividend stocks hence the name Dividend Equity ETF. My total return as of today is over $2000 dollars. We will get into why I chose this one and what other options there are for you later on!

What are Index Funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) designed to track the performance of a specific market index, such as the S&P 500. Rather than aiming to beat the market, index funds aim to replicate its returns by holding a diversified portfolio that mirrors the index’s composition.

One of the key advantages of index funds lies in their simplicity. Instead of picking individual stocks, which can be daunting for beginners, index funds offer instant diversification. By investing in an index fund, you indirectly own a small portion of every company within the index, spreading your risk across various sectors and minimizing the impact of individual stock fluctuations. This is why I love them!

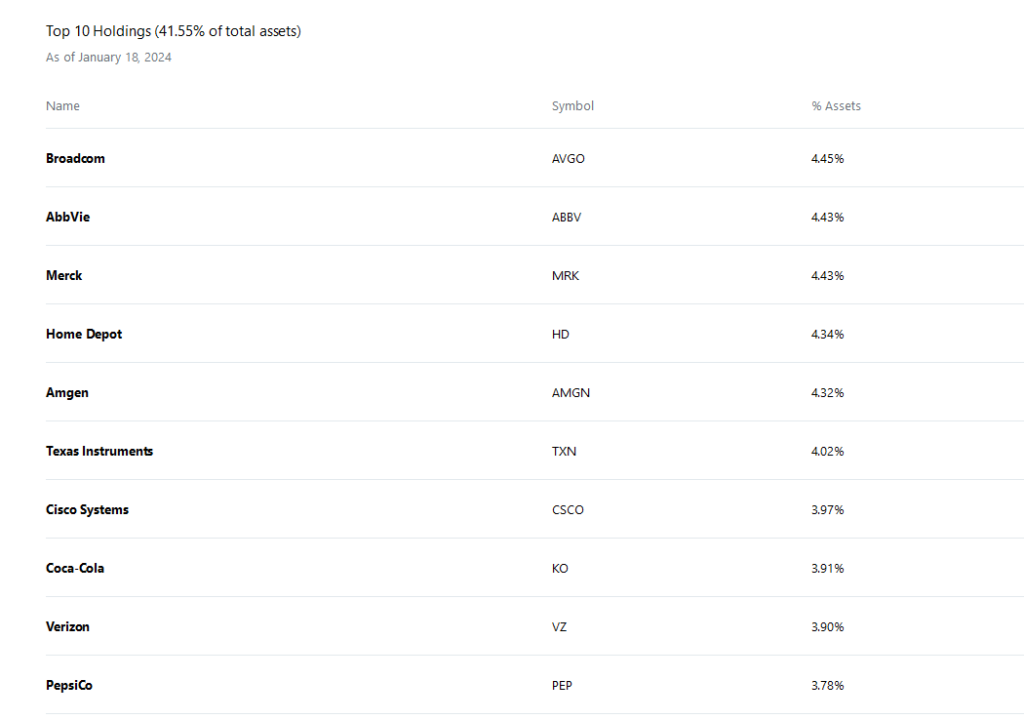

This is just an example of the index fund that I am investing in SCHD and their top 10 company holdings. As you can see there are very well known companies included and it offers diversification. These are not the only companies, SCHD is comprised of 100 companies in different sectors focused on dividends. Instead of investing in these companies one by one why not just invest into all of them with SCHD. There is less risk involved!

Why are Index Funds Appealing?

Index funds are known for their cost-effectiveness. Traditional actively managed funds often charge higher fees for professional management, but index funds operate on a passive strategy, resulting in lower expenses. These lower fees mean more of your money stays invested and has the potential to grow over time.

If you don’t want to actively be looking at stock prices and worrying about the risk involved with choosing individual stocks. Over the long term, this passive approach of investing in index funds has shown consistent and competitive returns, making index funds an attractive option for investors seeking steady growth.

As you can see the average annual return is very appealing! You can be making 13% on your investment with SCHD. This is a passive way to make money on a good investment. There are many more index funds like this and we will see some more later on!

How To Look For A Good Index Fund

For beginner’s in both investing and the world of index funds, the initial experience might feel a bit daunting. Nevertheless, exploring index funds is an excellent entry point for beginners in the stock market. Conducting thorough research is crucial to make informed investment decisions.

Some things to consider when looking for a good index fund:

1. Expense Ratios Matter:

Look for index funds with low expense ratios. These fees can impact your overall returns, and opting for funds with lower expenses ensures a more significant portion of your investment contributes to potential gains.

2. Track Record of Performance:

Evaluate the historical performance of the index fund. While past performance doesn’t guarantee future results, a fund with a consistent track record of mirroring its benchmark index effectively is a positive indicator.

3. Diversification Across Sectors:

A good index fund should provide broad market exposure by investing across various sectors. This diversification minimizes the impact of poor-performing industries on your overall investment.

4. Reputation of the Fund Provider:

Consider the reputation of the fund provider. Opt for index funds offered by reputable financial institutions or asset management companies with a history of reliability and transparency.

5. Understand the Index Being Tracked:

Each index fund is designed to replicate the performance of a specific market index. Understand the index being tracked to ensure it aligns with your investment objectives. Common indices include the S&P 500, Dow Jones Industrial Average, and Total Stock Market Index.

Index Funds To Consider In 2024

Disclaimer: I am not a financial consultant. As always, you should consult a financial advisor and do your own research before investing in the stock market.

Here are 5 of the index funds you may want to consider in 2024. Again, always consult a financial advisor before investing.

- SCHD (Schwab U.S. Dividend Equity ETF):

- Benchmark Index: Dow Jones U.S. Dividend 100 Index

- Description: SCHD focuses on high-dividend-yielding U.S. stocks, aiming to provide investors with a steady income stream along with the potential for long-term capital appreciation.

- VOO (Vanguard S&P 500 ETF):

- Benchmark Index: S&P 500 Index

- Description: VOO seeks to track the performance of the S&P 500, representing a broad range of large-cap U.S. stocks. It provides investors with exposure to the overall U.S. stock market.

- SPY (SPDR S&P 500 ETF Trust):

- Benchmark Index: S&P 500 Index

- Description: SPY is one of the oldest and most widely traded ETFs, mirroring the performance of the S&P 500. It offers investors a straightforward way to gain exposure to the largest U.S. companies.

- VTIAX (Vanguard Total International Stock Index Fund Admiral Shares):

- Benchmark Index: FTSE Global All Cap ex US Index

- Description: VTIAX provides global diversification by investing in a broad array of international stocks, excluding those from the United States. It covers developed and emerging markets.

- VTSAX (Vanguard Total Stock Market Index Fund Admiral Shares):

- Benchmark Index: CRSP US Total Market Index

- Description: VTSAX is designed to track the CRSP US Total Market Index, providing investors with exposure to the entire U.S. stock market, including stocks of all market capitalizations.

Dividends For Your Index Fund

Almost all index funds will offer a dividend yield which is important to know about.

- What Are Dividends? Dividends are periodic payments made by companies to their shareholders as a distribution of profits. In the context of index funds, these dividends are received based on the stocks held within the fund.

- Dividend Yield: Dividend yield is a key metric that indicates the annual dividend income as a percentage of the fund’s net asset value. It provides insights into the income-generating potential of your index fund.

Here is an example of this past year and the dividends I earned holding this index fund! As you can see every 3 months I get a dividend and it goes up every 3 months because I continue to put money in. Lets talk about consistency now!

Index Fund Investing Strategy

In my case what I have done is invest $200 every week and I started back in 2019! Obviously I did not start with $200 I actually started with around $50 a week and as I saw growth I asked myself. What if I invested more?

Well, I did and I have seen tremendous growth over the years and as I continue to invest the number will just keep rising.

The Bottom Line

Hopefully this article has helped get your feet wet in the world of index funds. A index fund is a great place to start and can hopefully help you get consistent growth for your hard earned money. Also check out my article on Dividend Investing if you are interested to learn more!

Get a FREE Stock with Robinhood today by clicking here! Buy a index fund within minutes or maybe your free stock will be a index fund! Even better!