Over the course of 5 years I’ve been working on creating a passive income stream. Known as dividend investing. For the year 2023, I was able to make almost $1,500. Basically $100 a month! I know it doesn’t sound like a lot but I know in few years this number will just continue to grow.

Today we’ll explore the art and science of dividend investing, uncovering the strategies and insights that can help you build a great portfolio generating steady income. Whether you’re a seasoned investor or just starting on your financial journey, dividend investing offers a pathway to create passive income streams that can potentially grow over time.

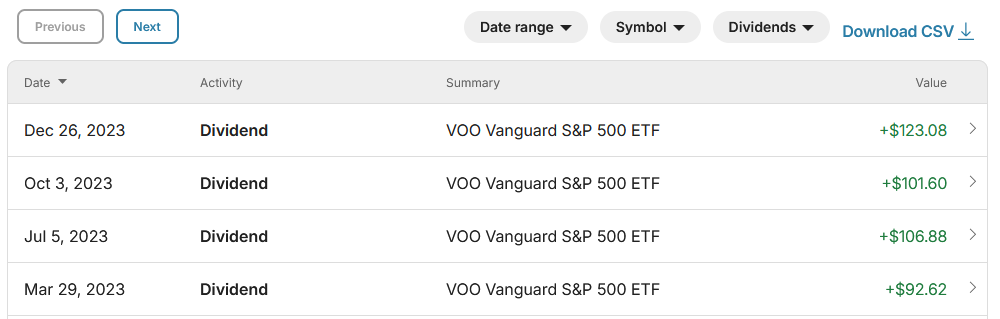

Here is exactly how much I was able to make for the year 2023! In total 1,251.23 with 2 different accounts, that’s just mind blowing to me.

The Appeal of Dividend Investing

Passive Income: Dividend investing is renowned for its ability to generate regular income. Companies with a history of paying dividends often continue to do so, providing investors with a predictable cash flow.

Long-Term Growth: Reinvesting dividends can lead to the compounding effect, where your investment grows not just from the initial capital but also from the reinvested dividends. Over time, this can significantly boost your overall returns.

Resilience in Market Volatility: Dividend-paying stocks tend to exhibit more stability during market downturns. The income generated from dividends can act as a buffer, helping investors weather periods of market volatility.

Building Your Dividend Portfolio

Here’s some important factors to keep in mind when building your portfolio!

- Dividend Yield: The dividend yield is a crucial metric, representing the annual dividend income as a percentage of the stock’s current price. It helps you assess the income-generating potential of a stock.

- Dividend History: Companies with a consistent history of dividend payments often signal financial health and stability. Look for stocks with a track record of increasing or maintaining dividends over time.

- Payout Ratio: The payout ratio, calculated as the dividends paid divided by the company’s earnings, indicates the sustainability of dividend payments. A lower payout ratio suggests that a company has more room to maintain or increase dividends.

Dividend Aristocrat Stocks

A dividend aristocrat refers to an S&P 500 stock that has consistently raised its dividend annually for a minimum of 25 years. This increase involves raising the monetary value of dividends per share. It’s important to note that dividend aristocrats are not required to augment their dividend yields over time. (Dividend yield, expressed as a percentage, is determined by dividing the last 12 months of dividends per share by the current share price and varies with market fluctuations.)

Presently, there are 66 dividend aristocrats, comprising a diverse group spread across various sectors, including healthcare, consumer staples, finance, and industry. Despite their diversity, they share a couple of key characteristics.

Firstly, they are well-established, having met the stringent 25-year dividend-raising criterion, which requires a minimum of 25 years as a publicly traded company. Notably, you won’t find newer entrants to the stock market, such as Tesla, among the dividend aristocrats. Secondly, all dividend aristocrats are large-cap stocks, as being part of the S&P 500 necessitates a market capitalization of at least $13.1 billion.

Here are some of my recommendations. There are many more stocks to choose from always do your research when investing.

1. Johnson & Johnson (JNJ):

- Sector: Healthcare

- Overview: Johnson & Johnson is a diversified healthcare company with a strong global presence. It engages in pharmaceuticals, medical devices, and consumer health products.

- Dividend Yield: Johnson & Johnson historically had a dividend yield of around 2.5% to 2.8%.

2. Procter & Gamble (PG):

- Sector: Consumer Staples

- Overview: Procter & Gamble is a consumer goods giant, known for its extensive portfolio of household and personal care products.

- Dividend Yield: Procter & Gamble’s dividend yield has been in the range of 2.3% to 2.7%.

3. Coca-Cola (KO):

- Sector: Consumer Staples

- Overview: Coca-Cola is a global beverage company with a focus on a variety of non-alcoholic beverages.

- Dividend Yield: Coca-Cola traditionally had a dividend yield of approximately 3.0% to 3.5%.

4. 3M (MMM):

- Sector: Industrials

- Overview: 3M is a diversified industrial company, offering products across various sectors, including adhesives, healthcare, and consumer goods.

- Dividend Yield: 3M’s dividend yield has historically been around 3.0% to 3.5%.

5. AbbVie Inc. (ABBV):

- Sector: Healthcare

- Overview: AbbVie is a pharmaceutical company with a focus on developing and commercializing therapies in various therapeutic areas.

- Dividend Yield: AbbVie’s dividend yield has been in the range of 3.5% to 4.0%.

High-Dividend ETFs For Passive Income

This is my personal strategy. In theory, individual stocks have the potential to outperform funds and market indexes, but they come with inherent risks. Thorough research is crucial before purchasing individual stocks, and this process can be time-consuming, especially when considering a diverse portfolio of stocks. Additionally, the cost of acquiring shares in numerous individual stocks can be significant.

Employing dividend-paying ETFs can serve as an excellent strategy for individuals seeking to add cash flow and broaden their investment portfolio. These ETFs provide a straightforward means of gaining exposure to a particular investment niche – specifically, stocks that consistently pay dividends.

The dividends received can be utilized to bolster income, a practice commonly adopted by retirees. Alternatively, you have the option to reinvest these dividends back into the fund, leveraging the power of compound interest to foster the growth of your investment portfolio. Regardless of your chosen approach, dividend-paying ETFs simplify the process of incorporating a diverse range of investments into your portfolio seamlessly.

Here are some of my recommendations. There are many more ETFs to choose from make sure to always do your research.

1. Schwab U.S. Dividend Equity ETF (SCHD):

- Dividend Yield: Historically around 3% to 3.5%

- Focus: U.S. companies with a history of consistent dividends.

- Overview: Aims to track the Dow Jones U.S. Dividend 100 Index.

2. SPDR S&P Dividend ETF (SDY):

- Dividend Yield: Historically around 2.5% to 3%

- Focus: High-dividend U.S. stocks with a history of dividend growth.

- Overview: Seeks to track the performance of the S&P High Yield Dividend Aristocrats Index.

3. Vanguard High Dividend Yield ETF (VYM):

- Dividend Yield: Historically around 3% to 3.5%

- Focus: Seeks to track the performance of the FTSE High Dividend Yield Index.

- Overview: Provides exposure to U.S. stocks with relatively high dividend yields.

4. iShares Select Dividend ETF (DVY):

- Dividend Yield: Historically around 3.5% to 4%

- Focus: High-dividend U.S. stocks.

- Overview: Tracks the Dow Jones U.S. Select Dividend Index, emphasizing companies with a consistent history of paying dividends.

5. Vanguard Dividend Appreciation ETF (VIG):

- Dividend Yield: Historically around 1.5% to 2%

- Focus: U.S. companies with a history of increasing dividends.

- Overview: Seeks to track the performance of the NASDAQ US Dividend Achievers Select Index.

Can You Live Off Dividends?

Living off ETF dividends is achievable, but it requires meticulous planning. Striking a balance between the income generated by your investments and your expenses is crucial. A helpful guideline is the 4% rule, suggesting that you aim to withdraw approximately 4% from your retirement savings each year. This rule assists in determining a sustainable withdrawal rate, ensuring a prudent approach to managing your financial resources.

For those aiming to sustain themselves with ETF dividends, it’s essential to factor in various income sources such as Social Security benefits, pension benefits, 401(k)s, IRAs, and any other financial streams. This comprehensive assessment allows you to gauge the potential gaps and determine the extent to which ETF dividends can contribute to meeting your overall income needs.

How To Invest In Dividend ETFs

Investing in a dividend ETF offers instant diversification, incorporating dozens, if not hundreds, of dividend stocks. This diversification enhances the safety of your payout, as the impact of a few stocks reducing dividends is minimal on the overall fund dividend. Prioritizing a secure payout is crucial when considering any dividend investment.

Here’s a step-by-step guide on how to purchase a dividend stock ETF:

- Select a Diversified Dividend ETF: Look for a widely diversified dividend ETF, typically found on your broker’s website. A recommended choice is a low-cost fund that selects dividend stocks from the S&P 500 stock index, providing a diverse mix of leading U.S. companies.

- Analyze the ETF: Ensure that the ETF is focused on stocks (equities) rather than bonds. Evaluate the following factors:

- Dividend Yield: Examine the annual dividends relative to share price, usually presented as a percentage.

- 5-year Returns: Higher returns are generally preferable.

- Expense Ratio: Check the ETF’s annual fee, aiming for an expense ratio below 0.50%, with lower being better.

- Stock Size: Dividend ETFs may invest in large, medium, or small-cap stocks. Large caps are considered safer, while small caps entail higher risk.

- Assets Under Management (AUM): This indicates the fund’s size. Be cautious with funds promising high dividends but having low AUM, as they might pose risks.

- Purchase the ETF: Acquire the ETF through an online broker, treating it like a regular stock purchase. Consider a systematic buying approach to leverage dollar-cost averaging benefits.

If you want to check out some investing platforms you can start to invest in click the button down below and sign up. You will get a bonus!

The Bottom Line

Dividend investing offers a compelling approach to creating passive income streams while fostering long-term wealth. By carefully selecting dividend-paying stocks, diversifying your portfolio, and implementing smart reinvestment strategies, you can embark on a journey that aligns with your financial objectives. Remember, patience is key in dividend investing, as the true power lies in the compounding nature of time. Start building your passive income streams today, and let the dividends pave the way for a financially secure tomorrow. Happy investing!