Welcome to an exploration of one of the most potent forces in finance – compound interest. In this blog post, we’ll dive into the concept of compound interest using real-world examples to illustrate its transformative potential. Strap in, because by the end of this journey, you’ll understand why Einstein called compound interest the eighth wonder of the world.

I bet you’ve heard the buzz about compound interest and the urgency of getting a head start on your retirement savings. It’s one of those financial mantras that’s drilled into us from an early age, like “eat your veggies” or “look both ways before crossing the street.”

Let’s face it – when you’re young, retirement feels like a distant speck on the horizon, barely registering on the radar of life’s priorities. It’s challenging to grasp the significance of socking away money for the future when the present demands seem so much more immediate and pressing.

That’s where relatable examples come in handy. Sometimes, seeing the numbers laid out in a real-world scenario is the push we need to take our savings game up a notch. And trust me, I’ve got not just one but two compelling examples that will make you sit up and take notice.

Here’s the thing about compound interest – it’s a game-changer, but only if you give it time to work its magic. The earlier you start, the better. It’s like planting a tree – the best time to do it was 20 years ago, but the second-best time is now.

In this post, we’re going to delve into two examples that vividly illustrate the power of compound interest, showing how starting early can significantly ease the burden of retirement savings down the road. So buckle up and get ready to witness the financial journey of two individuals who took different paths – one early bird and one late bloomer – and see firsthand how time truly is money.

Example 1: Sarah – The Early Bird

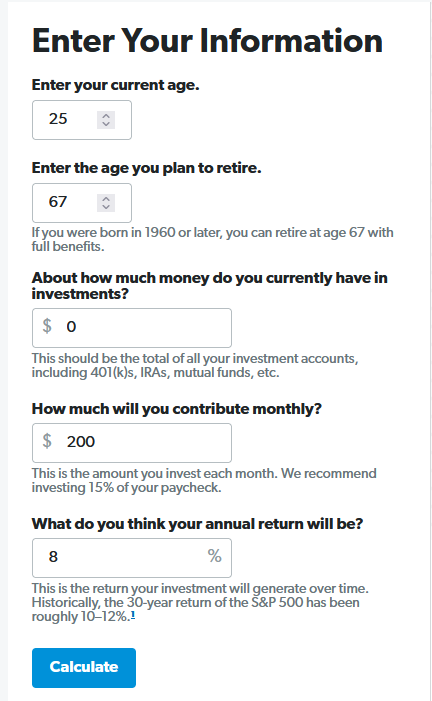

Meet Sarah, a diligent saver who started investing for her retirement at the age of 25. She began by putting aside $200 per month into a diversified portfolio with an average annual return of 8%, compounded annually.

Here is a quick overview of the information Sarah started with! As you can see the age of retirement in the US is 67. So let’s assume Sarah had 42 years to invest $200 every month. Let’s take a closer look.

- Year 1: After the first year, Sarah’s investment grows to $2,490.00.

- Year 10: By the tenth year, her investment has grown to $36,589.00.

- Year 30: Fast forward thirty years, and Sarah’s investment has ballooned to an impressive $298,071.00.

- Year 42: After forty two years of disciplined investing, Sarah’s retirement nest egg has grown to a staggering $824,098.00.

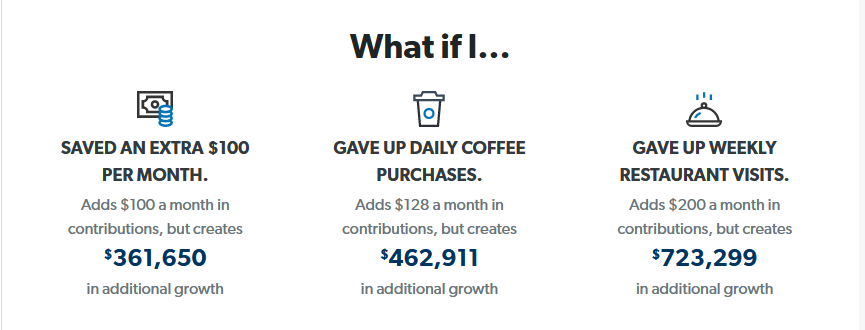

Now what if Sarah was to invest more per month? Well lets take a look!

As you can see the more Sarah was to invest the amount over 42 years is massive!

Let’s make sure we start as early as possible because compound interest is truly a wonder of the world!

Example 2: John – The Procrastinator

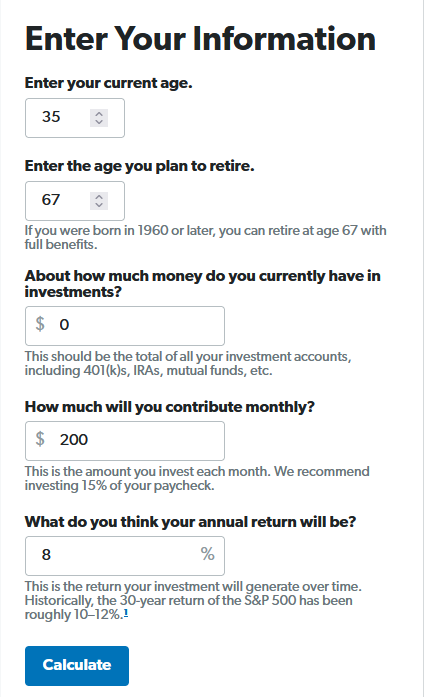

Now, let’s meet John, Sarah’s friend who didn’t start investing until he turned 35. Like Sarah, John also decides to invest $200 per month into the same diversified portfolio with an average annual return of 8%, compounded annually.

Here is a quick overview of the information John started with! As you can see the age of retirement in the US is 67. So let’s assume John had only 32 years to invest $200 every month, which is only 10 years less than when Sarah started to invest. Let’s take a closer look.

- Year 1: After the first year, John’s investment grows to $2,490.00.

- Year 10: By the tenth year, his investment has grown to $36,589.00.

- Year 20: Fast forward twenty years, and John’s investment has grown to $117,803.00.

- Year 32: After thirty two years of investing, John’s retirement fund has reached $354,791.00.

Do you see the difference in the amount just by missing 10 crucial years? It’s less the half the amount Sarah has. This is the power compound interest has over time.

The Magic of Compounding: A Tale of Two Paths

Despite investing the same amount of money, Sarah’s early start gave her investments an extra decade to compound, resulting in nearly three times the amount of wealth compared to John.

This stark contrast highlights the incredible power of compound interest and the significant impact that starting early can have on long-term wealth accumulation.

Real-World Application

Compound interest isn’t just a theoretical concept – it has real-world implications that can profoundly impact your financial well-being. By understanding the concept of compound interest and harnessing its power through disciplined investing, you can set yourself on the path to long-term wealth accumulation and financial independence.

Key Takeaways

- Start Early: The earlier you start investing, the more time your money has to compound and grow.

- Stay Consistent: Regular, disciplined investing is key to maximizing the power of compound interest.

- Reinvest Earnings: Reinvesting your investment earnings allows you to capitalize on the compounding effect and accelerate the growth of your portfolio.

- Choose Wisely: Selecting the right investment vehicle with a favorable rate of return and compounding frequency is crucial for maximizing your investment growth.

The Bottom Line

Compound interest is a financial superpower that has the potential to transform your financial future.

By understanding the concept of compound interest and harnessing its power through disciplined investing, you can set yourself on the path to long-term wealth accumulation and financial independence.

So, start investing early, stay consistent, and watch your money multiply over time – the power of compound interest is truly extraordinary.